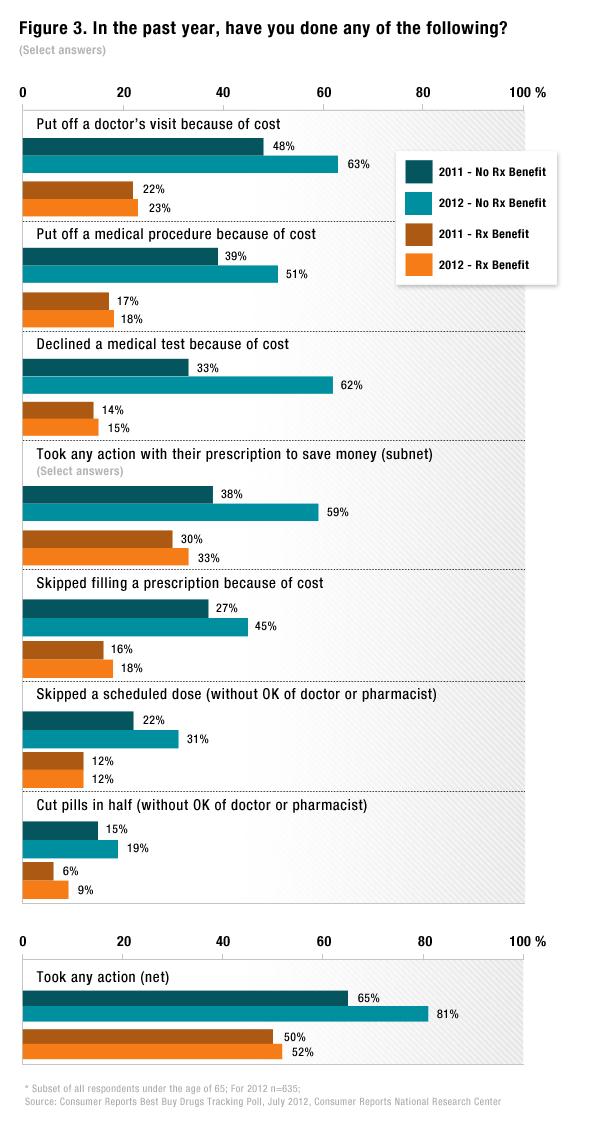

New data from Consumer Reports shows that 67% more adults without prescription benefits under the age of 65 skipped filling a prescription due to high drug prices this year compared to last year. In 2012, 45% of respondents reported they did not fill a prescription due to cost, up from 27% in 2011.

Consumer Reports Best Buy Drugs Tracking Poll, July 2012,

Consumer Reports National Research Center. Click to enlarge.

These results should not be surprising. Many Americans aged 50-65 who lost their jobs during the recession also lost their health insurance. This age group has also had the most difficulty finding work after losing their jobs during the recession. These Americans are not yet eligible for Medicare Part D, which helps reduce prescription drug costs.

Alarmingly, the majority of respondents (both insured and uninsured) to the Consumer Reports survey said that they reduced other household expenses in order to pay for medications. Eighty-four percent of uninsured Americans reported a change in behavior in order to pay for medication. The number of insured Americans reporting a change is also high, at 59%. Budgets for groceries decreased, payment of bills postponed, and credit card payments increased: all because of the high cost of medication.

If you are struggling to pay for medication, keep the following in mind when about to purchase medication. Look for generic alternatives to brand name medications in the United States. Look for drug discount cards or coupons if you are purchasing medicine at a local pharmacy. If there’s no generic alternative, you can look for international online pharmacies and often find savings of 90%. Just make sure they are verified and safe, such as those listed on PharmacyChecker.com.

Tagged with: Consumer Reports, Drug Prices, Medication Adherence, pharmacychecker.com

I have been using a discount drug card to help me pay for my prescription medications. Medicationcoupons.com has saved me and my family a lot of money over the past few years. I have no insurance and struggle to pay my bills, let alone my medication. Their card saves me over $250 a month onmy meds. Without insurance, even the generics are too expensive.