by Gabriel Levitt, Vice President, PharmacyChecker.com and Sam Werbalowsky, Pharmacychecker.com | Oct 17, 2012 | Medicare Drug Plans

Open enrollment for Medicare Part D (Drug Plans) began this week. If you are eligible for Medicare Part D, and want to sign up for a plan or change your current plan, you should be sure to find the plan that works best for you.

Be sure to check out MedicareDrugPlans.com to compare and contrast plans; and don’t worry – plan ratings are completely objective, as we are not affiliated with any plan. In fact, the ratings are provided by people who actually use the plans, based on criteria like deductible, monthly premium, drug coverage, and customer service. Perhaps even more helpful than the ratings are the written reviews where Medicare Part D enrollees explain their experiences with plans, often expressing frustration with formularies that change mid-year, problems at the pharmacy using the plans, or copay issues. If you want to recommend (or steer people away from) a plan, make sure to leave a rating and review.

Once you’ve chosen a plan based on ratings and reviews, head to the government’s site, Medicare.gov to make sure the plan covers your medications, compare final costs and sign up for it. The average premium nationally is $53.55, which is down over a dollar than last year. The maximum drug deductible is $325, up $5 from last year

There are changes for enrollees who enter the coverage gap (“donut hole”) this year. While some plans do offer gap coverage for generics and brand name medication, most do not. However, once you enter the donut hole, you get a 50% discount on covered brand-name drugs, though the drug’s whole value will go towards closing the gap.

As open enrollment begins, Medicare enrollees interested in a drug plan are urged to research carefully. Whatever plan you choose will go into effect starting January 1st, 2013 and last for one full year – so get it right! Visit MedicareDrugPlans.com now!

Tagged with: Medicare Drug Plans, Medicare Part D, medicaredrugplans.com

by Gabriel Levitt, Vice President, PharmacyChecker.com and Sam Werbalowsky, Pharmacychecker.com | Apr 6, 2012 | Saving Money on Prescription Drugs, Skipping medications

Some pharmaceutical industry folks, and their political allies, like to make the point that our nation’s seniors no longer need access to lower-cost foreign medication because they now have new and improved Medicare drug plans. But a new report by IMS indicates that drug costs are having a negative effect on public health, including for our seniors’. Put simply, the data indicates that even with the improvements and savings offered by Part D of Medicare (Medicare’s drug benefit), seniors still struggle to afford the drugs they need.

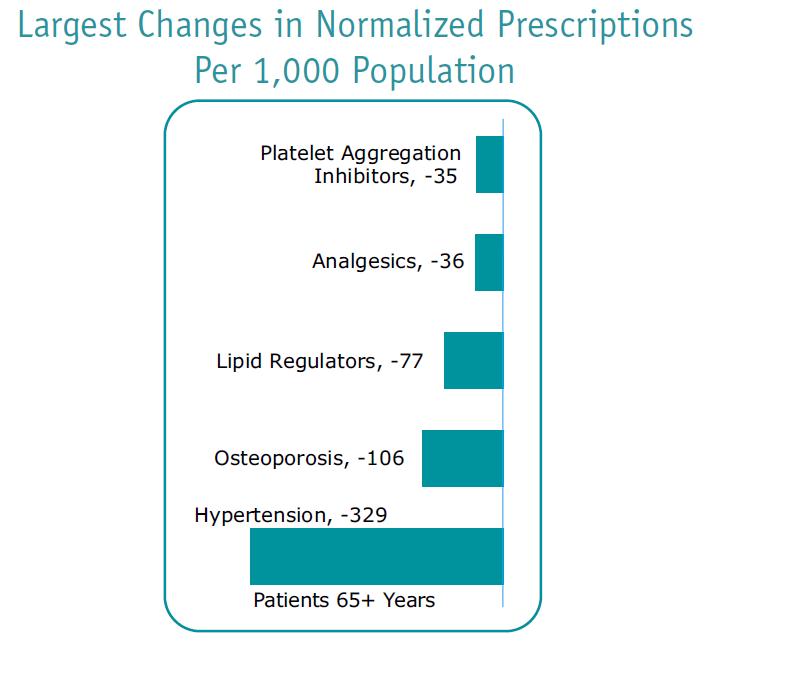

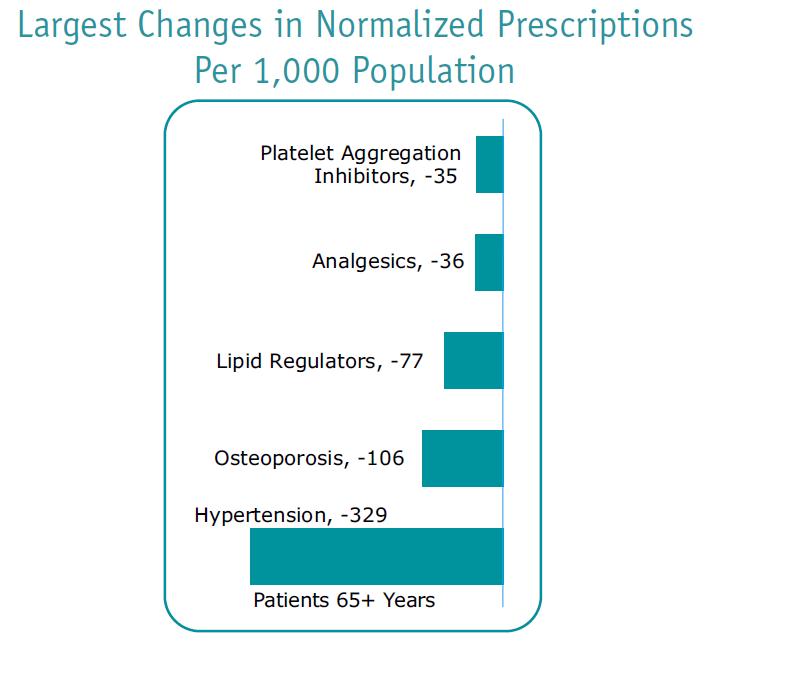

According to the report, medicine use by 65-year-olds decreased 3.1% — the largest decrease in any age group. As reported in the New York Times, Michael Kleinrock, director of research development at the IMS Institute for Health Informatics, a group that consults for the drug industry, said that seniors appear to be “rationing their care as they struggled to pay rising bills on fixed incomes.” Mr. Kleinrock also said, “We’re reaching a tipping point where patients will actually take that increased cost and use less medicine.” Leigh Purvis, who studies drug prices for the AARP explains that the drugs most often cut are those “where you don’t necessarily develop symptoms when you stop taking them.”

Source: IMS Health, LifeLink, Dec 2011; U.S. Census Bureau

Such cutbacks in drug utilization for needed medication are known to lead to increased emergency room visits and greater social costs. Indeed, according to the IMS data, emergency room visits are up by 7.4%. Other studies, such as one by the Commonwealth Fund, have shown that medication nonadherence (skipping your prescribed medication) has been linked to increased emergency room visits, hospital stays, and nursing home admissions. The new IMS report illustrates this correlation as it finds seniors cutting back on needed medication.

Some improvements to Part D of Medicare have already been implemented and the IMS data shows a $1.8 billion decrease in out-of-pocket spending on prescription medication that is likely due to these improvements. More improvements are on the way as long as the Affordable Care Act is not overturned. However, it’s clear that our seniors continue to suffer negative health consequences because of drug affordability problems.

A recent survey by RxRights.org, a non-profit group advocating for Americans who purchase medication from Canada and other countries, shows that just over half of people who personally import medication through online pharmacies are in Medicare. So even with Part D available to them, they actively seek lower drug prices outside the United States, making it abundantly clear that seniors continue to need the option to personally import prescription medication. It is important that they do so safely, using pharmacies approved by third-party verification programs such as PharmacyChecker.com.

Tagged with: affordable prescriptions, Drug Importation, Drug Prices, IMS Institute for Healthcare Informatics, Medicare Drug Plans, Medicare Part D, seniors

by PharmacyChecker.com | Oct 10, 2011 | Drug Prices, Medicare Drug Plans

An article published last week in Reuters suggests that Medicare Part D drug plans may be dropping premium prices – an effect of the healthcare reform law which could greatly benefit seniors if they shop around. Reevaluating your Medicare drug plan yearly during the open enrollment period is always a good idea, but this year plan selection could make a big difference.

Although we reported in August that plan premiums will not raise in 2012, Avalere Health, a health policy consulting firm, finds that while 10 of the top Part D plans will lower prices, six plans will raise premiums. However, the good news is that in the larger picture Avalere “projects that average premiums for both prescription drug and Advantage plans will fall 4 percent for 2012.” Because of the 2010 heath reform law, Dan Mendelson, Avalere Health’s CEO, is calling this a “year of change.” He tells Reuters, “It’s a year where patients really need to shop.”

MedicareDrugPlans.com provides ratings and reviews – along with basic plan information such as deductibles and premiums– for consumers to access during their research period. Ratings and comments help Medicare enrollees understand the pros and cons of a plan, and user comments and forum posts give details on what other Americans experienced with their plans.

Open enrollment will be from October 15th – December 7th this year, a change from previous years meant to give Medicare enough time to process all changes and new enrollees, and for consumers to manage their health needs before the busy holiday season.

Tagged with: Avalere Health, deductibles, Drug Prices, Medicare, Medicare Drug Plans, Medicare Part D, medicaredrugplans.com, Open Enrollment, premiums, Reuters, save money